What are union dues?

Sometimes things can sound promising on the surface, but it’s important to remember the old saying: “There’s no such thing as a free lunch.” Unions and union dues are a perfect example. You have to carefully weigh whether what the union promises is truly worth the cost, and whether that money could be better spent on things that directly benefit you.

Like any business, unions depend on revenue to survive. Their main source of income is mandatory union dues. These dues fund the union’s operations, including salaries for union officials, conventions, and other activities that often have little or no direct benefit to you or your workplace.

Union dues aren’t cheap. While the exact amount varies, they typically range from 1.5% to 2% of your hard-earned wages every month. Over a year, that adds up to several hundred dollars, often with little transparency.

Before committing to a union, it’s worth asking yourself: Is the return really worth the price? Could you use that money more effectively on something that benefits you directly, without the middleman?

Take a close look at what membership could cost you.

What happens to the dues the union collects?

Where does the money go? Hear from former union organizer, Nancy Jowske.

It’s important to know that union dues don’t pay for your health insurance, pension, or other benefits—those are funded by the company and, in many cases, by employee contributions.

Instead, the money collected through dues is used to cover the union’s own expenses, including salaries and benefits for union officials, administrative costs, and other overhead tied to running the union itself.

Unions are required to file an annual financial report, known as an LM-2, which outlines their income and expenses. These reports are available to the public and can be downloaded from the U.S. Department of Labor’s website (see footer for details).

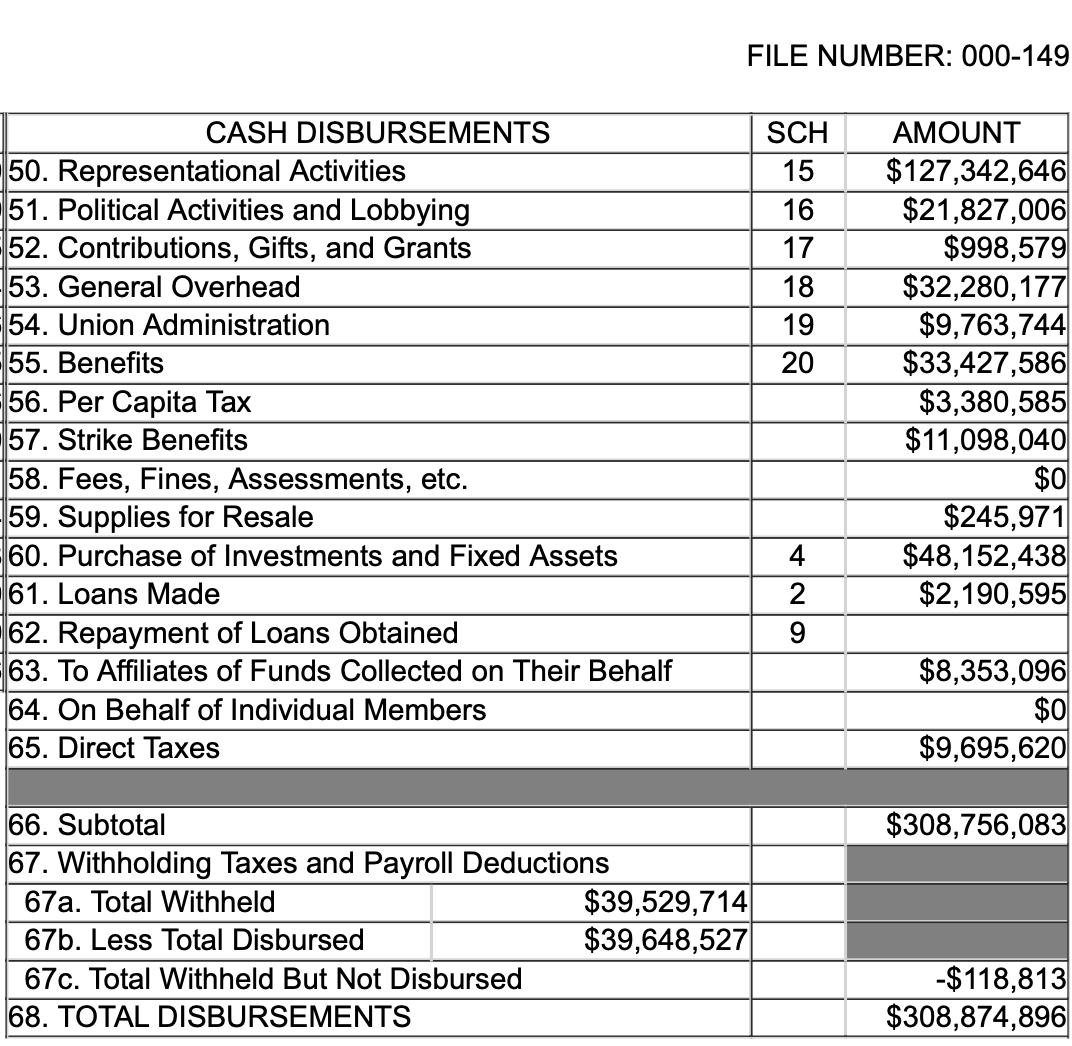

For example, the UAW’s 2024 LM-2 filing shows that the union collected nearly $300 million in that year alone. A closer look at the cash disbursements section reveals that a large portion of those funds went toward salaries, benefits, and perks for union officials and staff.

Be cautious when you see categories labeled “On Behalf of Individual Members”; unions aren’t required to provide a detailed breakdown of how that money is actually spent, making it easy for them to classify nearly any expense as benefiting members.

How much does it really cost?

| 401(K) Plan Calculator | |

|---|---|

| Enter your monthly dues amount | |

| What is your estimated Rate of Return on your 401(k)? | |

| How many years until you retire? | |

| Total dues spent | |

| Total Amount You Could Save In Your 401k Plan (Plus Company Match) | |

| This is an estimate. Actual results may vary. | |

Use the Dues vs. Investment Calculator to get a quick idea.

- Enter your anticipated monthly dues amount.

- Select the estimated Rate of Return on your 401(k). (Historically, the average rate of return is 7%.)

- Input the number of years remaining until you plan to retire.

You will see the total amount you will pay in dues, as well as the amount that you could have earned by investing it. That is the REAL lost value! Again, these are based upon estimates, and actual amounts can vary.

Consider This: Airstream matches non-union 401(k) contributions at 50% of the first 6% of your contribution. That’s a great return on your investment!